Property taxes collected from residential and non-residential properties are one of the various revenue sources available to the City of Edmonton to pay for municipal services. Learn more about how property taxes fund the City's programs and services at Budget and Finances.

The City of Edmonton distributes property tax notices in late May every year and asks property owners to pay their taxes in full by the due date of June 30 to avoid late-payment penalties.

Launch MyPropertySign up or sign in to explore your property assessment and tax data.

Launch Property Tax EstimatorSee how much a property of a certain value is estimated to pay in property taxes this year.

Launch Property Tax Estimator

Enrol for The Monthly Payment PlanHave your monthly property tax amount withdrawn directly from your bank account on the first business day of each month.

Enrol for The Monthly Payment Plan

The City of Edmonton’s Property Tax Monthly Payment Plan allows you to pay your property taxes by pre-authorized automatic bank withdrawal and spread your property tax payments over the year.

You may be able to add your property taxes to your mortgage payments. The mortgage lender through which you pay your mortgage can add your tax payments to your mortgage payment and submit payment to the City on your behalf. Many lenders offer this service to their mortgage customers.

The City sends you the original property tax notice for your records. The name of the mortgage lender being billed appears on your tax notice. Contact your financial institution to confirm that the payment is being made on your behalf.

Mortgage lenders submit payments by June 30. However, it can take up to 15 business days for the payment to show on your tax account. After the third week of July, check your property's transaction history or account balance report on MyProperty, our secure site for property owners.

You can pay taxes in full through your mortgage company.

In person at your financial institution

Before making a payment in person at your bank, confirm that your bank accepts "in-person paper payments" using the remittance portion of your property tax notice.

Some financial institutions will process payments at a teller only if their clients have been set up for online banking.

If paying at an ATM, keep your receipt as proof of the date and time of payment.

Online banking

When making your payment online, consult with your financial institution to ensure you are set up for online banking. Each bank has its own payment code for the City of Edmonton taxes.

Link this payment code to the account number indicated on your property tax notice, particularly if you have purchased a new home.

If you own multiple properties, submit a separate payment to each account number indicated on your property tax notices.

Be aware of your financial institution's policy on the effective date and time of online payments to avoid late-payment penalties.

The City of Edmonton does not accept credit cards directly as a method of paying property taxes.

Several third-party online payment service providers offer a credit card payment option for the payment of property taxes. You may be able to use this option to pay property taxes to the City of Edmonton.

Note that these companies will charge you a transaction fee for this service. The City of Edmonton does not receive any of the transaction fee when this method of payment is used.

If you choose to pay property taxes through a third-party payment service provider, ensure you are fully aware of its policy on the effective date of payment. In some cases, it may take several business days for the transaction to reach the City.

You are responsible for making sure the City of Edmonton receives your payment by the due date. If your payment arrives past the due date for payment, you will be subject to late-payment penalties.

If you wish to pay taxes by mail, send a cheque or money order and the remittance portion of your tax notice to the following address:

City of Edmonton

PO Box 1982

Edmonton, AB T5J 3X5

When sending your payment by mail, allow ample time for the payment to arrive prior to the deadline. The envelope must be post-marked by Canada Post by the due date to avoid late-payment penalties. The City is not responsible if payments are not received.

Cheques that are incomplete or filled out incorrectly can not be cashed and will be returned. This may result in late payment penalties.

When paying by cheque, ensure it is signed, dated and completed accurately (body and figures match). The City is not responsible for errors and omissions.

If the City cannot process your payment due to an error on the cheque or insufficient funds, late-payment penalties and service charges may apply to your account.

We encourage you to sign in to MyProperty.edmonton.ca . This secure service offers a lot of property tax information, including the latest property tax notice, the latest tax account balance, a two-year transaction history and a five-year property tax history of your property.

Once you create a profile on MyProperty.edmonton.ca and attach your property, you will have access to your current and future property tax notices for as long as you own your property. You can view the notices in the My Mail section of the MyProperty website.

If it’s been more than 10 business days and your cheque is still not cashed, you may wish to place a stop payment on this cheque through your bank and send the City a replacement cheque to cover the missing payment. The City is not responsible for any banking fees associated with issuing stop payments.

To view your current property tax account balance and transaction history, sign into MyProperty.edmonton.ca.

Information about payments received after May 1 does not meet our internal printing deadline date, and will not be reflected in the balance shown on your tax notice. We apologize for this inconvenience.

If you want to see your current tax account balance, sign in to MyProperty.edmonton.ca or call 311.

Mortgage lenders submit their tax payments by the June 30 deadline. It can take up to 15 business days for their payment to show up on your tax account.

Contact your lender to confirm the payment is being made on your behalf, call 311 after the third week of July to confirm the payment has been applied to your account or sign into MyProperty.edmonton.ca to view your current property tax account balance and transaction history.

If the City does not receive full payment on time, you will be subject to late-payment penalties.Corrections or changes to mailing addresses, owner names and changes of ownership are administered by Alberta Land Titles. The City of Edmonton receives these updates electronically once they have been processed by Alberta Land Titles.

You can request a change of mailing address by submitting a Change of Address form. Changes or corrections to owners name and changes of ownership can be made by submitting the appropriate forms to Alberta Land Titles.

If you receive a "Please wait. " message opening PDF forms

1. Right-click on the link

2. Choose the option to Save or Download the form to a known location on your computer, such as your desktop

3. Locate the file on your local computer

4. Open the file using Adobe Reader

Property Tax Monthly Payment Plan Application:

If you receive a "Please wait. " message opening PDF forms

1. Right-click on the link

2. Choose the option to Save or Download the form to a known location on your computer, such as your desktop

3. Locate the file on your local computer

4. Open the file using Adobe Reader

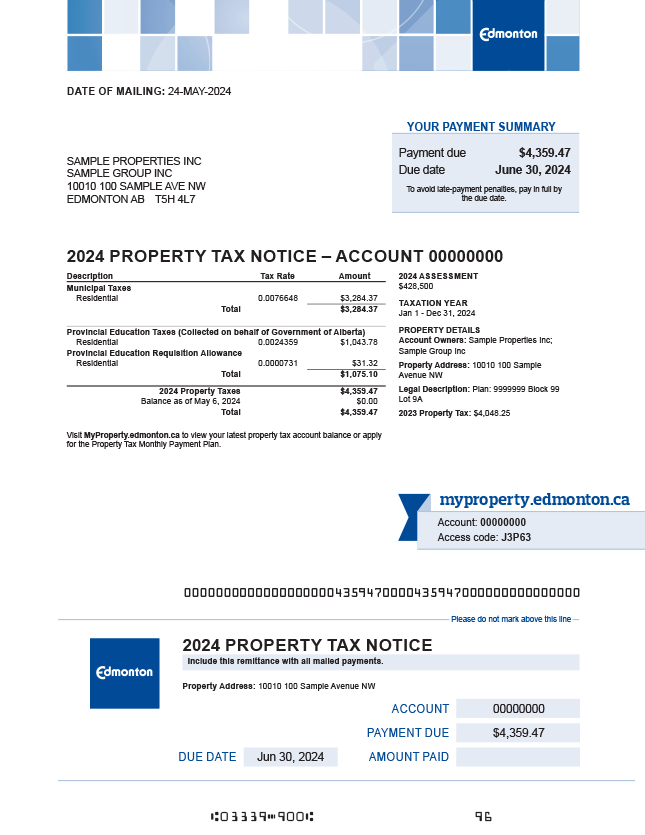

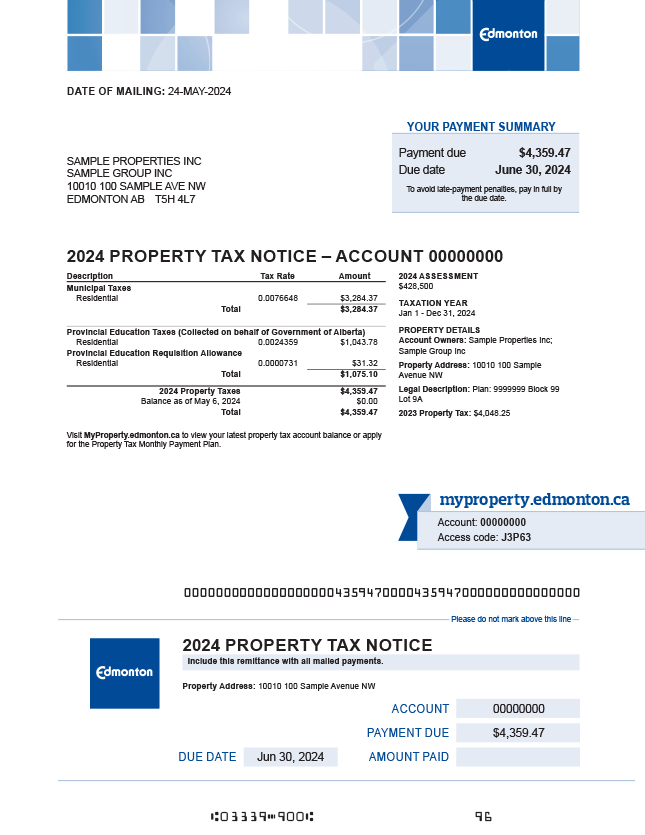

As a property owner in Edmonton, you receive a property tax notice every May. It indicates your share of municipal and education property taxes and the due date for payment.

If you did not receive a tax notice, you can request a copy of your most recent property tax notice.

The City believes it is important for you, as a property owner, to fully understand the information shown on your tax notice. This interactive tax notice explains the information categories in your notice. To access descriptions, click on the sections that are of interest to you.

Drag to view image

Tap on hotspots to learn more.

Show interactive image

The date the City of Edmonton mailed this property tax notice.

The name and mailing address of the property owner.

Property owners need to submit this payment amount in full to avoid late-payment penalties.

Property tax payment is due by this date.

Property owners need to make tax payment by this date to avoid late-payment penalties.

Municipal property taxes are set by the City of Edmonton and help pay for a variety of services the City provides. These services include:

To learn how your portion of the municipal property taxes is calculated, refer to Municipal Taxes.

Provincial education property taxes are set by the Government of Alberta and directed to fund public and separate school boards. Each year, the City collects and forwards to the Government of Alberta Edmonton’s portion of the total provincial education tax amount.

Provincial education property taxes consist of provincial education taxes and a provincial education requisition allowance.

All property owners in Edmonton, residential and non-residential, are required to pay education property taxes including those without children in school and senior citizens. If you have questions about education taxes and funding, please contact the Government of Alberta at 780-422-7125.

To learn how your portion of the education Property Tax is calculated, refer to Education Property Tax.

This field indicates the total amount of current year’s property taxes.

The amount in this field is calculated as a sum of the municipal tax, provincial education tax, provincial education requisition and local improvement charges, if applicable.

Any overdue balance or credit amount is indicated here.

The identification number of your property as it appears on the City’s files.

To help us address your concerns more effectively, please have this number available when making an inquiry.

Your property is assessed at the amount indicated in this field. This amount acts as a basis for calculations of the property taxes.

Provincial legislation requires that the assessment reflect the market value of your property as of July 1st of the previous year.

All properties are assessed using similar factors that real estate agents and appraisers use when pricing a home for sale.

If your property was only partially completed as of December 31, your assessment reflects the value of the lot plus the value of the building, based on the percent complete.

If the building is completed during the current year, a supplementary assessment and tax notice will be sent to the assessed person reflecting the increase in assessment from new construction.

This year’s property tax notice covers taxes from January 1 to December 31.

According to the City's records, these individuals (or companies) are registered property owners.

The municipal street address of your property.

The legal identifier of the land on which your property is located.

This amount indicates the previous year’s municipal and provincial education property taxes for your property.

It may be different from the amount stated on your last annual tax notice if your property was subject to an assessment correction, Assessment Review Board decision, a supplementary or amended assessment, a change in exemption status or a change in property use.

We encourage you to sign up for myproperty.edmonton.ca -- your trusted, secure source for property assessment and tax information.

After you create a profile with your own email and password, use this access code to add your property. This access code is unique to your property.

This remittance slip provides a summary of your property tax payment and the due date for payment.

The City encourages all property owners to resolve any questions about property taxes well in advance of the due date for payment and submit the payment in full by June 30 to avoid late-payment penalties.

The City accepts several forms of property tax payments. If you choose to pay by mail, include this remittance with your cheque and ensure your cheque is made payable to “City of Edmonton,” signed, dated and completed accurately.

To learn how you can submit your property tax payment, refer to Ways to Pay.

The municipal street address of your property.

Property tax payment is due by this date.

Property owners need to make tax payment by this date to avoid late-payment penalties.

The identification number of your property as it appears on the City’s files.

To help us address your concerns more effectively, please have this number available when making an inquiry.

This amount of property taxes is due for payment.

Property owners need to submit this payment amount in full to avoid late-payment penalties.

For internal use only: the City's staff uses this field to document the amount received for payment of property taxes.

The total amount due for payment by June 30.

This amount may be different from this year’s property tax amount and is calculated after any overdue or credit balance has been applied.

| Municipal | Education | Education Requisition Allowance | Total Rate | |

|---|---|---|---|---|

| Residential/Farmland | 0.0076648 | 0.0024359 | 0.0000731 | 0.0101738 |

| Other Residential (multi) | 0.0085846 | 0.0024359 | 0.0000731 | 0.0110936 |

| Non-Residential | 0.0226627 | 0.0037321 | 0.0000683 | 0.0264631 |

Each year, the City reviews how much money it needs to pay for municipal programs and services that are necessary to maintain and enhance Edmonton’s high standard of living.

The budget process allows City Council and Edmontonians to identify where the money is needed most and helps determine the budget to meet those needs. As part of this process, the City considers where the money to cover municipal programs and services comes from. One of the revenue sources for any municipality in Canada is property taxes.

To ensure that all Edmonton property owners pay their fair share of property taxes, the City follows the guidelines established by the provincial government and uses a property assessment process.

By legislation, the City collects only enough taxes to support its programs and services—it cannot collect more and it cannot collect less.

Your property taxes are broken down into 2 major elements—municipal and education property taxes—and may also include local improvement charges and community revitalization levy allocation, if applicable.

Ultimately, by paying your share of property taxes, you contribute to the financial stability of our community and support the quality of life for which Edmonton has become known. For more see Understanding Your Property Tax .

January 15, 2024

Property assessment notices mailed to all Edmonton property owners.

January 15, 2024 – March 25, 2024

The 2024 Assessment Review Period. Remember you can file a formal complaint about your property's assessed value, but you cannot file a formal complaint against your property tax bill.

March 25, 2024

Deadline for filing formal property assessment complaints.

March/April

The Government of Alberta establishes its budget to fund the provincial education system. The City of Edmonton must collect provincial education property taxes from Edmonton property owners on behalf of the provincial government.

May 2024

Property tax notices mailed to all property owners.

June 30, 2024

Deadline for payment of property taxes.

Property characteristics

City assessors use similar criteria that property appraisers and real estate agents use when pricing a home for sale. For example:

Information resources used by the City include

Your current property assessment notice indicates the City’s estimate of your property’s market value—the amount it would have sold for in the open market—on July 1 of the previous year. And, it is adjusted for any changes in physical condition recorded by December 31. Provincial legislation establishes these dates and requires that property assessed values be estimated every year.

If your property was only partially complete as of December 31, your assessment notice will reflect the value of the land plus the value of the building, based on its completion percentage. The City will issue a supplementary assessment notice that will reflect the value of newly completed construction.

To ensure assessed values are fair and accurate, they are reviewed at 3 levels:

The City uses the assessed value of your property to calculate the amount of provincial education and municipal property taxes you pay in proportion to the value of the real estate you own.

A change in assessed values affects property taxes in the following manner:

Average assessed value change

=

Average municipal tax increase

If your property’s value change is similar to the average, city-wide assessed value change, you will see a tax increase that is similar to the average municipal tax increase.

Higher than average assessed value change

=

Higher than average municipal tax increase

If your property’s assessed value changed by more than the average assessed value change, you will see a greater than the average municipal tax increase.

Lower than average assessed value change

=

Lower than average municipal tax increase

If your property’s assessed value changed by less than the average assessed value change, you will see a tax increase that is less than the average municipal tax increase.

To determine if your tax increase will be more or less than the average, review our assessment change reports to compare the percentage change in the assessed value of your property with the average assessment change for all residential properties in Edmonton. Also, take advantage of our tax estimator .

Remember your tax bill that arrives in May also includes a provincial education tax amount. The City is required to collect that tax on behalf of the Government of Alberta.

When you receive your property assessment notice in January, take the time to fully review it. You have until the review period deadline to correct the information stated on your notice.

In 2024, the customer review period is open from January 15 to March 25.

We encourage you to review your property’s new assessed value, check MyProperty for details specific to your property and get in touch with us by calling 311 (780-442-5311, if outside Edmonton). Our property assessment experts can answer most assessment-related questions—with no formal complaint fees required.

If the City or a property owner discovers an error, omission or incorrect description in any of the information shown on the property assessment notice, the City may issue an amended assessment notice.

Property owners have 60 days from the time of the mailing to review the notice.

If you’ve come across an error or disagree with information stated on your amended assessment notice, review your property's information through MyProperty and get in touch with us by calling 311 (780-442-5311, if outside Edmonton).

Our property assessment experts can answer most assessment-related questions—with no formal complaint fees required.